Howdy, future real estate moguls! Texas is known for its booming rental property market, making it an ideal place to invest. Understanding how to properly value a rental property is crucial for making informed decisions and ensuring a profitable investment. In this guide, we will walk you through the important steps to accurately valuing a rental property in the Lone Star State. From analyzing market trends to evaluating rental income potential, we’ve got you covered. Let’s saddle up and explore the world of real estate valuation in Texas!

Key Takeaways:

- Location is crucial: When valuing a rental property in Texas, consider the location carefully as it can significantly impact the rental income and property value.

- Understand market trends: Stay informed about the local real estate market trends in Texas, such as rental demand, vacancy rates, and property appreciation, to make a more accurate valuation.

- Calculate potential income: Factor in potential rental income, operating expenses, property taxes, and other costs to determine the cash flow and overall value of the rental property in Texas.

Understanding the Types of Rental Property Valuation

For a beginner looking to value a rental property in Texas, it’s crucial to understand the different types of property valuation approaches. The most common valuation methods are the Income Approach, Sales Comparison Approach, and Cost Approach. Each approach has its unique way of determining the value of a rental property, and knowing how to apply them will help you make informed decisions as an investor.

- Income Approach

- Sales Comparison Approach

- Cost Approach

Assume that you want to learn more about these valuation methods, you can refer to Beyond the Basics of Buying a Rental Property.

Income Approach

Little income less expenses, like taxes, insurance, maintenance costs, and vacancies, equals the net operating income (NOI). By dividing the NOI by the property value, you get the capitalization rate, a crucial factor in determining the property’s value.

Sales Comparison Approach

The Sales Comparison Approach compares the rental property to similar properties that have recently sold in the area. By looking at these comparable sales, you can determine the fair market value of the property based on what similar properties have sold for.

| Factors | Details |

| Location | Comparing properties in the same neighborhood or area |

| Size | Matching the square footage and number of bedrooms/bathrooms |

| Condition | Assessing the property’s condition and any upgrades |

| Age | Evaluating the age of the property and any renovations |

| Market Trends | Considering current market conditions and demand |

Cost Approach

Approach assuming the property is worth what it would cost to replace it with a similar structure. Factors such as depreciation, land value, and construction costs are taken into account to determine the property’s value accurately.

Types of depreciation to consider include physical deterioration, functional obsolescence, and external obsolescence, all of which can impact the overall value of the rental property.

Key Factors to Consider When Valuing a Rental Property

Even for beginner investors, valuing a rental property is a crucial step in determining its potential for generating income. By considering several key factors, you can make an informed decision about whether a property is a sound investment. Recognizing the value of these factors will help you navigate the process more effectively. For a comprehensive guide on valuing rental properties, check out How to Value a Rental Property.

Location and Neighborhood

Location plays a significant role in determining the market value and potential rental income of a property. Factors such as proximity to amenities, schools, public transportation, and safety can influence the desirability of a rental property.

Property Condition and Age

One of the key factors in valuing a rental property is its condition and age. A well-maintained property with modern amenities is likely to attract higher-quality tenants and command higher rental rates. Older properties may require more maintenance and upgrades, impacting their value and potential rental income.

Rental Income and Expenses

With rental income, you should consider the potential rental yield of the property, taking into account both the rental income and expenses such as property taxes, insurance, maintenance costs, and property management fees. By accurately estimating these figures, you can determine the profitability of the investment.

Market Trends and Competition

Neighborhood market trends and competition can also impact the value of a rental property. Understanding the rental demand in the area, vacancy rates, and comparable rental prices can help you assess the property’s potential for generating income.

For instance, an oversaturated rental market may lead to lower rental prices and higher vacancy rates, affecting the property’s profitability. Stay informed about market trends and competition to make informed decisions about your rental property investments.

Other Articles You Might Enjoy:

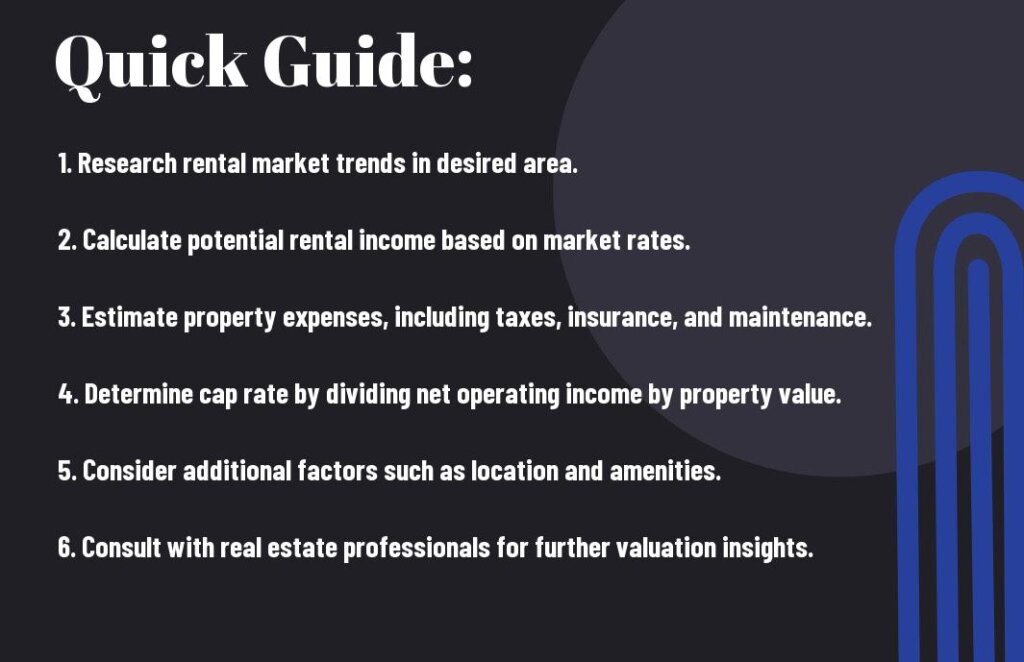

Step-by-Step Guide to Valuing a Rental Property

Gathering Data and Information

On the first step, gather all the necessary data and information about the rental property. This includes details such as the property’s address, size, age, number of bedrooms and bathrooms, amenities, recent renovations, and rental history.

Calculating the Property’s Value

On the second step, calculate the property’s value using methods such as the income approach, sales comparison approach, and cost approach. These methods will help you determine the market value of the rental property.

Plus, consider factors such as market trends, location, demand for rental properties in the area, and potential rental income when calculating the property’s value.

Analyzing the Results and Making Adjustments

Any discrepancies or variations found during the valuation process should be carefully analyzed. Make any necessary adjustments to the calculations based on this analysis to ensure an accurate valuation of the rental property.

Analyzing the results thoroughly will help you make informed decisions about the rental property, whether it’s purchasing, selling, or renting it out. Consider consulting with a real estate professional for a more detailed analysis if needed.

Tips and Pros and Cons of Different Valuation Methods

Advantages and Disadvantages of the Income Approach

If you are considering using the Income Approach to value a rental property in Texas, it’s important to weigh the pros and cons. This method is great for investors looking to generate rental income, but it requires accurate and up-to-date financial data. Additionally, the Income Approach may not be the best choice for properties with irregular or inconsistent rental histories.

Benefits and Drawbacks of the Sales Comparison Approach

To evaluate the Sales Comparison Approach for valuing a rental property, it’s imperative to understand its advantages and disadvantages. This method is excellent for determining market value based on comparable sales data, but it may not be suitable for unique or customized properties. Additionally, the Sales Comparison Approach relies heavily on the availability of recent and relevant sales data in the local market.

Benefits and Drawbacks of the Sales Comparison Approach

| Benefits | Drawbacks |

| Establishes market value accurately | May not account for unique property features |

| Relies on recent and relevant sales data | Not suitable for properties with limited comparables |

Considerations for Using the Cost Approach

When considering the Cost Approach for valuing a rental property, keep in mind the following considerations. This method provides a straightforward way to calculate replacement costs, but it may not reflect market value accurately if depreciation is not accurately assessed. Additionally, the Cost Approach is more suitable for newer properties with little depreciation.

Considerations for Using the Cost Approach

| Pros | Cons |

| Straightforward calculation of replacement costs | Depreciation assessment may vary |

| Best for newer properties | May not reflect market value accurately for older properties |

Summing up

Conclusively, understanding the key factors that influence the value of a rental property in Texas is vital for investors. Considering location, market trends, property condition, and operating expenses can help in accurately valuing a rental property and making informed investment decisions.

FAQ

Q: What factors should I consider when valuing a rental property in Texas?

A: When valuing a rental property in Texas, you should consider factors such as location, property condition, rental demand in the area, amenities, and potential for appreciation.

Q: How can I determine the rental income potential of a property in Texas?

A: To determine the rental income potential of a property in Texas, research comparable rental properties in the area, analyze current rental rates, and consider the property’s size, condition, and location to estimate the monthly rental income.

Q: What methods can I use to calculate the value of a rental property in Texas?

A: You can use methods such as the income approach, which analyzes the property’s potential income, the sales comparison approach, which compares the property to similar properties that have sold recently, and the cost approach, which estimates the cost to rebuild the property minus depreciation.

Want to see what investment properties we have available? Click here now and fill out the form, or call our office at (346) 214-6340.

About The Company

Texas Equity Connect is a premier real estate investment firm dedicated to uncovering off-market property deals across Texas. We streamline the process by presenting these exclusive opportunities directly to our network of investors, eliminating the hassle of deal-hunting. Join our VIP Investors List to receive top-tier deals delivered on a silver platter.