There’s a saying in Texas that goes, “Buy land, they’re not making it anymore.” Concerning investing in rural property in the Lone Star State, it’s imperative to weigh the pros and cons before diving in headfirst. From wide-open spaces to potential challenges like infrastructure and market volatility, navigating rural real estate in Texas requires a keen eye and a touch of Texan wisdom. So saddle up, partner, as we ride through the ups and downs of investing in rural property in the great state of Texas.

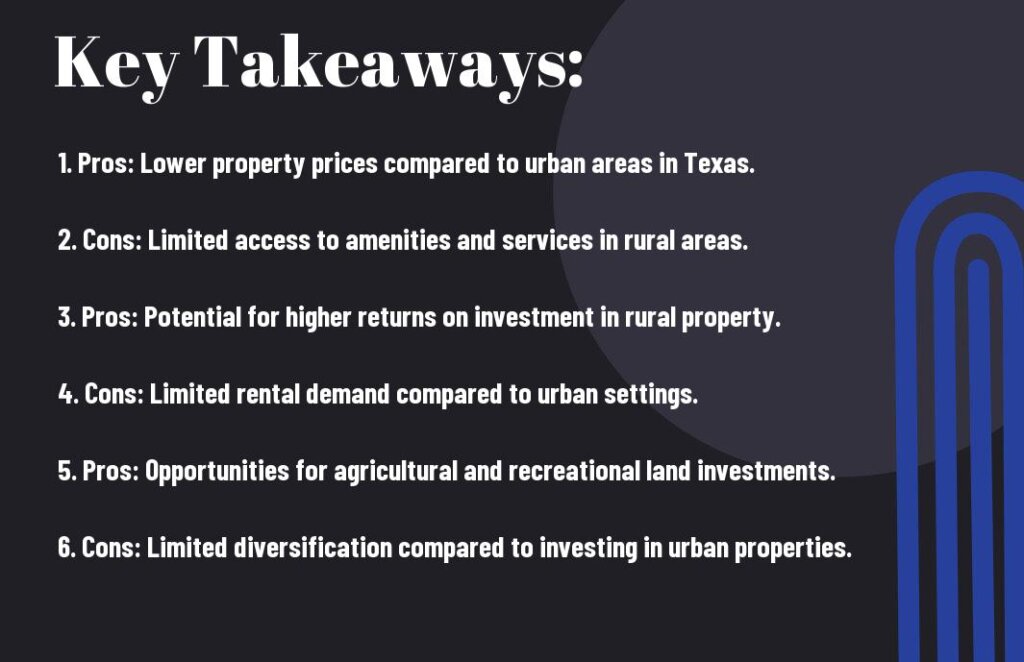

Key Takeaways:

- Pros: Investing in rural property in Texas can offer tranquility and a slower pace of life away from the hustle and bustle of the city.

- Cons: However, challenges such as limited access to amenities and services, as well as potential difficulties in resale value, should be considered before making a decision.

- Overall: Just like Mark Twain once said, “Buy land, they’re not making it anymore.” Investing in rural property in Texas can be a rewarding experience if you weigh the pros and cons carefully and make an informed decision that suits your lifestyle and investment goals.

The Allure of Rural Texas Properties

Wide Open Spaces

Ahh, Texas, where the land seems to stretch on forever under the big, open sky. The allure of rural Texas lies in the vast open spaces that offer a sense of freedom and tranquility away from the hustle and bustle of city life.

Affordable Land Prices

To sweeten the deal, rural Texas boasts some of the most affordable land prices in the country. This makes it an attractive option for those looking to invest in property without breaking the bank.

With the affordable land prices in rural Texas, investors have the opportunity to start or expand their property portfolio without draining their savings account. Whether you’re looking for a small plot of land or a sprawling ranch, there is something for every budget in the Lone Star State.

Pros of Investing in Rural Property Texas

Potential for High Returns

Returns on rural property investments in Texas can be lucrative, offering potentially high yields compared to urban real estate. The value of land in rural areas has the potential to appreciate significantly over time, providing investors with a profitable long-term investment opportunity.

Diversification of Investment Portfolio

On top of the financial benefits, investing in rural property in Texas allows for diversification of your investment portfolio. This diversification can help spread risk across different asset classes, providing a cushion against market fluctuations in other sectors.

For instance, while urban properties may be influenced by factors like economic downturns or oversupply, rural properties tend to be more stable due to their intrinsic value as agricultural or recreational land. This stability can offer a reliable source of income and asset appreciation, making rural property a valuable addition to any investment portfolio.

Opportunity for Agricultural or Livestock Income

High demand for agricultural products and livestock in Texas presents investors with the opportunity to generate additional income from their rural property. By leasing the land for farming or ranching purposes, investors can tap into the lucrative agricultural market and benefit from the state’s robust agricultural sector.

Agricultural activities not only provide a steady source of income but also contribute to the local economy and promote sustainable land use practices. This dual benefit makes investing in rural property in Texas a rewarding venture for those looking to diversify their income streams and make a positive impact on the environment.

The Challenges of Rural Property Investment

Remote Location and Limited Amenities

Rural properties in Texas often come with the challenge of being located far from urban centers, resulting in limited access to amenities such as shopping centers, healthcare facilities, and entertainment options. This remote location can make it challenging for property owners to attract tenants or buyers looking for convenience and accessibility.

Zoning and Land-Use Regulations

Challenges may arise with zoning and land-use regulations in rural areas, which can restrict the type of developments or activities allowed on the property. Navigating these regulations can be complex and time-consuming, requiring investors to conduct thorough research and seek guidance from local authorities.

Another aspect to consider is the potential restrictions on building new structures or making changes to existing ones. Investors may need to obtain permits or approvals before undertaking any construction or renovation projects on their rural property.

Maintenance and Upkeep Challenges

For rural properties, maintenance and upkeep can be more demanding compared to urban properties due to factors like long driveways, large acreage, and exposure to the elements. Property owners may need to budget for regular maintenance, repairs, and landscaping to keep the property in top condition and preserve its value.

A proactive approach to maintenance is necessary to prevent issues such as overgrown vegetation, pest infestations, or structural deterioration. Hiring reliable contractors and staying on top of routine maintenance tasks can help rural property owners avoid costly repairs in the long run.

Economic Considerations

Once again, if you’re considering investing in rural property in Texas, it’s imperative to weigh the economic factors. For a detailed analysis of the economic aspects, you can refer to The Pros And Cons of Purchasing A Rural Property.

Local Economy and Job Market

Economy plays a crucial role in the desirability of rural property investments. Assess the local job market and economic growth potential in the area before making a decision.

Property Taxes and Insurance

An important factor to consider is the property taxes and insurance costs associated with owning rural property. These expenses can vary significantly based on the location and features of the property.

Infrastructure Development and Access

The infrastructure in rural areas can impact the property’s value and accessibility. Consider factors like road maintenance, internet connectivity, and proximity to imperative services before investing.

Environmental Concerns

Natural Disasters and Climate Risks

Keep in mind that investing in rural property in Texas comes with the risk of natural disasters and climate-related challenges. Texas is no stranger to extreme weather events such as hurricanes, tornadoes, floods, and droughts that can impact property value and management.

Conservation Efforts and Wildlife Management

Risks associated with rural property investment in Texas include the need to navigate conservation efforts and wildlife management regulations. As a landowner, you may face restrictions on land use to protect endangered species and their habitats. It’s vital to understand these responsibilities before making a purchase.

Wildlife: Understanding wildlife management practices and regulations is crucial for rural property investors in Texas. Landowners must balance conservation efforts with property development while respecting the local ecosystem and biodiversity.

Water Availability and Quality

On top of that, the availability and quality of water sources can pose challenges for rural property owners in Texas. Drought conditions and water rights issues may impact the usability and sustainability of the land for agricultural or recreational purposes.

Investing in rural property in Texas requires careful consideration of environmental factors such as natural disasters, conservation efforts, wildlife management, and water availability. Being well-informed about these concerns can help you make sound investment decisions and mitigate potential risks in the long run.

Lifestyle and Community

Now, before venturing into the pros and cons of investing in rural property in Texas, make sure to check out The Pros and Cons of Buying Land as an Investment in Texas for some insightful tips.

Rural Living and Isolation

Community is crucial in rural areas. While living in the countryside offers peace and tranquility, isolation can be a factor. It’s important to consider if you’re comfortable with the quieter, more secluded lifestyle that rural living offers.

Building Relationships with Neighbors and Locals

Rural communities thrive on strong relationships. Getting to know your neighbors and locals can provide a sense of belonging and support network. Engaging in community events and activities can enrich your rural living experience.

To foster good relationships, participate in local events, lend a helping hand, or join community initiatives. This will not only integrate you into the community but also create a strong support system, which is crucial in rural areas.

Access to Healthcare and Education

An important aspect to consider when investing in rural property is access to healthcare and education. Rural areas may have limited medical facilities and schools, so it’s crucial to assess these factors before deciding on a property.

Understanding the proximity of hospitals, schools, and other crucial services is vital for your well-being and the education of your family members. Research the available healthcare providers and educational institutions in the area to make an informed decision.

To wrap up

Ultimately, investing in rural property in Texas can be a double-edged sword, like trying to milk a bull— sure, there are potential profits, but you might just get kicked in the process! It’s important to weigh the pros, like peace and quiet, against the cons, like distance to amenities. Recall, as Mark Twain once said, “Buy land, they’re not making it anymore.” So, whether you decide to take the plunge or not, just make sure you do your homework and cowboy up for the adventure!

If you want to start investing in rural real estate-sign up to our exclusive VIP investor list to get access to the latest rural real estate deals!

FAQ

Q: What are the advantages of investing in rural property in Texas?

A: Investing in rural property in Texas has its perks! One major advantage is the lower cost compared to urban areas. You can get more land for your buck, which is perfect for those looking to expand or start a new venture. Additionally, rural properties often offer a peaceful and quiet environment, away from the hustle and bustle of city life.

Q: What are some drawbacks of investing in rural property in Texas?

A: While there are many positives, it’s important to consider the cons as well. One downside of rural property in Texas is the lack of amenities and services compared to urban areas. You might have to travel further for groceries, medical care, or other necessities. Additionally, selling rural property can sometimes take longer as the market might not be as active as in urban areas.

Q: Are there any risks involved in investing in rural property in Texas?

A: Like any investment, there are risks to consider when investing in rural property in Texas. One risk is the potential for natural disasters, such as floods or wildfires, which could damage your property. Another risk is the fluctuation of commodity prices, as many rural properties are used for agriculture. It’s important to do thorough research and consider these factors before making a decision.

About The Company

Texas Equity Connect is a premier real estate investment firm dedicated to uncovering off-market property deals across Texas. We streamline the process by presenting these exclusive opportunities directly to our network of investors, eliminating the hassle of deal-hunting. Join our VIP Investors List to receive top-tier deals delivered on a silver platter.

Other Articles You Might Enjoy:

- Rental Property Operating Expenses: What Every Landlord Should Know

- Ultimate Guide: Finding Off-Market Properties in Texas

- Pros & Cons of Investing In Rural Property Texas